Are you a frequent traveler tired of managing your finances across borders? Digital banking offers a suite of features tailored to the needs of globetrotters, simplifying money management while on the go. From real-time transaction alerts and currency exchange tools to international money transfers and mobile check deposits, digital banking provides the convenience and security necessary for seamless financial management while traveling. Explore the transformative capabilities of digital banking and discover how it can enhance your travel experiences.

This article delves into the essential digital banking features that cater specifically to frequent travelers. Learn how to leverage these tools to avoid excessive foreign transaction fees, monitor your spending in real-time, and access funds conveniently from anywhere in the world. We’ll examine the benefits of features like mobile payments, virtual cards, and 24/7 customer support, empowering you to navigate the complexities of international finance with ease and confidence. Discover how digital banking can revolutionize your travel experience and alleviate financial stress on your next journey.

Multi-Currency Support

For frequent travelers, managing finances across different currencies can be a significant challenge. Multi-currency support within digital banking platforms simplifies this process considerably.

This feature allows users to hold and manage funds in various currencies within a single account. This eliminates the need for multiple bank accounts or prepaid travel cards, streamlining financial administration.

Key benefits of multi-currency support often include real-time exchange rates, transparent fee structures for currency conversion, and the ability to make payments and withdrawals in local currencies while abroad, minimizing transaction fees and maximizing convenience.

ATM Fee Reimbursements

One of the most significant advantages of certain digital banking accounts for frequent travelers is ATM fee reimbursement. These accounts often refund the fees charged by ATMs, both domestically and internationally, when you withdraw cash.

This feature can result in substantial savings, especially for those who travel frequently to locations where ATM fees are high. Some accounts offer unlimited reimbursements, while others may have a monthly or annual cap. It’s crucial to carefully compare these limits and choose an account that aligns with your travel patterns and expected cash withdrawal needs.

Key considerations when evaluating ATM fee reimbursement policies include:

- Domestic vs. international reimbursements: Some accounts may only reimburse fees incurred at international ATMs.

- Reimbursement limits: Pay close attention to any monthly or annual caps on reimbursements.

- Reimbursement process: Understand how reimbursements are credited to your account (e.g., automatically, upon request).

Free International Transfers

For frequent travelers, international money transfers are a common necessity. Free international transfers eliminate the often hefty fees associated with sending money abroad, resulting in significant savings. This feature is particularly beneficial for those who regularly send money to family members, pay international bills, or manage expenses in multiple currencies.

Many digital banks offer a limited number of free international transfers per month, while others may offer this feature as part of a premium account package. Be sure to understand the specific terms and conditions, including any limits on the transfer amount or eligible currencies.

Choosing a digital bank with free international transfers can simplify your finances and reduce the costs associated with travel and living abroad. Look for banks that offer transparent fee structures and competitive exchange rates to maximize your savings.

Travel Notifications and Settings

Real-time travel notifications are a crucial feature for frequent travelers using digital banking. These alerts can inform you of transactions made abroad, helping you monitor your spending and quickly detect any fraudulent activity.

Many digital banking platforms allow you to set travel dates and destinations. This proactive measure prevents your card from being blocked due to unusual international activity. It also allows the bank to provide location-specific security alerts and information.

You can often customize notification preferences. Choose to receive alerts for all transactions, transactions above a certain amount, or only for specific types of transactions.

Some banks also offer temporary card lock/unlock features. This provides an additional layer of security when you’re not actively using your card, allowing you to quickly disable and re-enable it as needed via the mobile app.

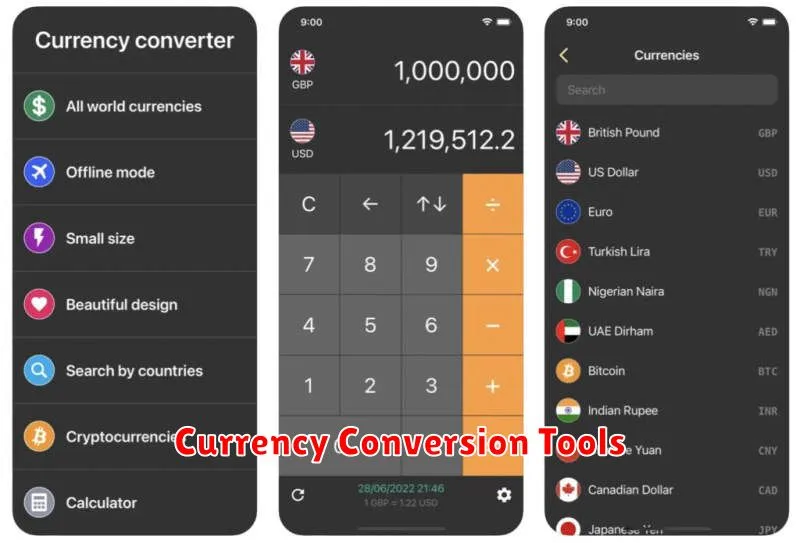

Currency Conversion Tools

Real-time currency converters are essential tools for frequent travelers. These tools allow you to quickly and easily check the current exchange rates between different currencies.

This feature enables travelers to make informed decisions about money exchange, budgeting, and spending while abroad. Knowing the exact value of your money in a foreign currency helps avoid overspending and ensures you get the best possible exchange rates.

Some digital banking apps offer built-in currency conversion calculators. These tools often provide historical exchange rate data, allowing you to track currency fluctuations and potentially time your exchanges for optimal rates.

Beyond basic conversion, some advanced tools may also allow you to set rate alerts. You can specify a target exchange rate and receive a notification when the rate reaches your desired level. This feature can be especially helpful for travelers planning large purchases or transfers.

Freeze Card Remotely if Lost

Losing your card while traveling can be a nightmare. Digital banking offers the ability to instantly freeze your card remotely, preventing unauthorized transactions. This feature provides peace of mind knowing that your funds are secure even if your physical card is misplaced or stolen.

Most banks provide this functionality through their mobile apps or online banking portals. Simply log in, navigate to the card management section, and select the option to freeze your card. This action typically takes effect immediately.

Once you’ve located your card or determined it’s truly lost, you can easily unfreeze it using the same method. If your card is unrecoverable, you can then report it lost or stolen and request a replacement through your bank’s app or website.