In today’s fast-paced digital world, managing your finances efficiently is crucial. Accessing your bank statements quickly and easily is a key component of this. This article will provide a comprehensive guide on how to download bank statements digitally, covering various methods and highlighting the benefits of digital banking. Learn how to download bank statements, access bank statements online, and understand the importance of digital banking for personal and business financial management.

Downloading bank statements digitally offers numerous advantages over traditional paper statements. It provides greater security, reduces clutter, and allows for easy access to your financial records whenever and wherever you need them. This step-by-step guide will walk you through the process of downloading your bank statements online, whether you’re using a computer, tablet, or smartphone. We’ll explore different banking platforms and provide clear instructions to ensure you can retrieve your digital bank statements with ease. Explore the options available for accessing your bank statements digitally and discover the convenience of managing your finances online.

Why Download Statements?

Downloading your bank statements offers several key advantages for managing your finances effectively and securely.

Easy Access and Organization: Digital statements provide quick access to your financial records whenever you need them. No more shuffling through paper files! You can organize them electronically by date, account, or any other system that suits your needs.

Enhanced Security: Downloaded statements are more secure than paper statements, which can be lost, stolen, or damaged. Securely stored digital copies protect your sensitive financial information.

Environmental Friendliness: Opting for digital statements reduces paper consumption, contributing to a more sustainable lifestyle. Reduce clutter and help the environment at the same time.

Efficient Record Keeping: Digital statements are crucial for tax preparation, budgeting, tracking expenses, and resolving discrepancies. Having easy access to these records simplifies these processes.

Proof of Transactions: Downloaded statements serve as verifiable proof of transactions for loan applications, rental agreements, and other situations requiring financial documentation.

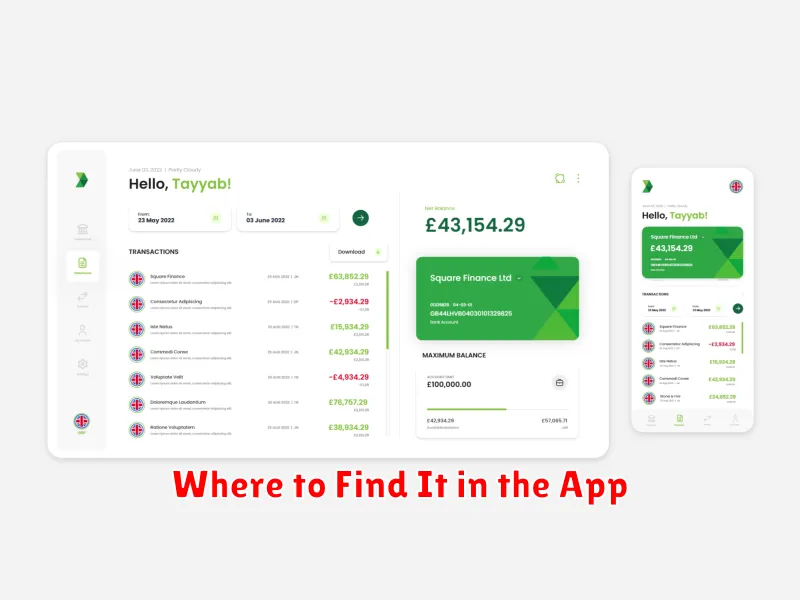

Where to Find It in the App

The location of the download feature for bank statements may vary slightly depending on the specific banking app you are using. However, there are some common places to look. Most often, this feature is found within the “Accounts” or “Statements” section of the app.

Once you have located the correct account, look for options labeled “Documents,” “Statements,” or “Download.” Sometimes, a small icon resembling a download arrow or a file may indicate the correct option. Be sure to select the correct statement period you require.

If you are having trouble locating the download feature, consult the app’s help section or contact your bank’s customer support.

Choosing Format and Time Range

Once you’ve located the download section within your online banking portal, you’ll need to specify the format and time range for your statement.

Common file formats include PDF, CSV, and QFX. PDFs are best for printing and viewing, while CSV and QFX are suitable for importing into financial software. Your choice depends on how you plan to use the statement.

Next, select the desired time period. Most banks offer options like “Last Month,” “Last 90 Days,” “Custom Range,” etc. For a custom range, you’ll typically input the start and end dates. Be sure to specify the correct dates to obtain the information you need.

Choosing the correct format and time range will ensure you download the right information efficiently. Review your selections before confirming the download.

Email vs Direct Download

When obtaining your bank statements digitally, you typically have two primary options: email or direct download. Each method has its own advantages and disadvantages.

Email delivery involves the bank sending your statement as an attachment, typically a PDF, to your designated email address. This can be convenient, especially if you need to forward the statement to someone else. However, it introduces a potential security risk as email is generally less secure than direct download.

Direct download, on the other hand, allows you to retrieve your statement directly from the bank’s website or mobile app. This method is generally considered more secure as it avoids the vulnerabilities associated with email. It often provides a wider range of statement formats and may offer more control over the download process.

Ultimately, the best choice depends on your individual needs and security preferences. If convenience is paramount and the statement isn’t highly sensitive, email may suffice. However, if security is a top priority, direct download is the recommended method.

Password-Protecting Files

After downloading your bank statements, a crucial step is securing them with a password. This adds an extra layer of protection, preventing unauthorized access to your sensitive financial information.

Most operating systems and file compression utilities offer built-in features for password protection. For example, you can create password-protected ZIP files. When creating the archive, you’ll be prompted to set a password. Remember to choose a strong password.

A strong password typically includes a combination of uppercase and lowercase letters, numbers, and symbols. Avoid easily guessable information like your birthdate or pet’s name. Consider using a password manager to generate and securely store strong passwords.

Regularly changing your password is also a good security practice. This further minimizes the risk of unauthorized access, even if a password has been compromised.

Organizing Statements Securely

Once you’ve downloaded your bank statements, maintaining their security is crucial. Consider these organizational practices:

Password-protected Folders: Store your statements in password-protected folders on your computer. Choose a strong, unique password that you don’t use for other accounts.

Encrypted Storage: For added security, consider encrypting the storage drive or the folder itself. This adds another layer of protection against unauthorized access.

Naming Conventions: Use a consistent and clear naming convention for your statement files. This helps you quickly locate the statement you need.

Regular Backups: Regularly back up your statements to a secure external drive or cloud storage service. This protects you from data loss due to hardware failure or other unforeseen events.

Retention Policy: Establish a clear retention policy for your statements. Determine how long you need to keep them based on your individual needs and legal requirements. Securely delete statements you no longer need.