Setting up savings goals is a crucial step towards achieving financial security. In today’s fast-paced world, it’s easy to lose track of our finances. Utilizing the savings goals feature within your banking app empowers you to take control of your money and work towards your financial aspirations, whether it’s a down payment on a house, a dream vacation, or simply building an emergency fund. This article will guide you through the process of setting up savings goals in your banking app, providing you with the tools and knowledge you need to succeed.

Learn how to effectively utilize your banking app to establish and manage your savings goals. We’ll cover everything from identifying your financial objectives and setting realistic targets to tracking your progress and making adjustments as needed. By leveraging the convenient features of your banking app, you can streamline the savings process and make significant strides toward your financial future. Discover how to harness the power of technology to achieve your savings goals and build a stronger financial foundation.

Why Set Savings Goals?

Setting savings goals is a critical step towards achieving financial security and realizing your dreams. It provides a clear roadmap and helps you prioritize your spending habits effectively. Without defined goals, saving can feel aimless and it’s easy to lose motivation.

Benefits of setting savings goals:

- Motivation: Having a specific target in mind makes saving more engaging and encourages consistent contributions.

- Planning: Defining goals allows you to create a realistic budget and timeframe for achieving them.

- Tracking progress: Monitoring your progress towards your goals provides a sense of accomplishment and keeps you on track.

- Financial security: Building savings provides a safety net for unexpected expenses and future needs.

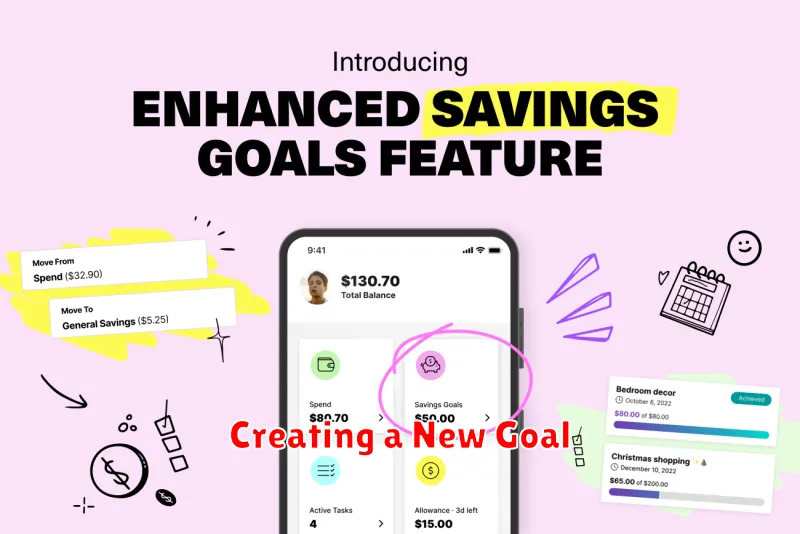

Creating a New Goal

To initiate a new savings goal, navigate to the Savings Goals section of your banking app. This is typically found within the main menu or dashboard. Once there, select the option to Add Goal or Create New Goal.

You will then be prompted to provide a few key details for your goal:

- Goal Name: Provide a descriptive name for your goal (e.g., “Down Payment on House,” “Vacation Fund”).

- Target Amount: Enter the total amount you wish to save.

- Target Date (Optional): If you have a deadline in mind, specify the date by which you’d like to achieve your goal.

- Initial Deposit (Optional): Start your goal off strong with an initial contribution.

After entering the required information, review the details and select Save or Create Goal to finalize the process.

Automated Transfers to Goals

One of the most effective ways to reach your savings goals is to automate your savings. Our app offers a seamless way to schedule recurring transfers to your designated Goal accounts.

Setting up automatic transfers is straightforward. From the Goals section of the app, select the Goal you want to fund. Then, choose the “Automated Transfer” option. You can then specify the amount, frequency (weekly, bi-weekly, or monthly), and start date for your recurring transfers.

You have complete control over these automated transfers. You can modify or cancel them at any time directly from the app. This flexibility ensures you can adapt your savings strategy as needed.

Automating your savings helps you build financial discipline and progress steadily toward your objectives without having to think about it.

Visual Progress Tracking

Visual progress tracking is a key feature for maintaining motivation and achieving your savings goals. Many banking apps offer tools like progress bars, charts, and graphs to visually represent your savings journey.

These tools allow you to quickly assess your progress at a glance. Seeing how far you’ve come and how much further you have to go can be incredibly encouraging. Some apps even allow you to project your savings growth based on your current contributions, providing a clear picture of your future financial standing.

Different visual representations can cater to various preferences. For example, a pie chart might show the proportion of your goal that has been reached, while a line graph might track your savings balance over time.

Modifying or Deleting Goals

Life changes, and so may your savings goals. Our banking app allows you to easily modify or delete existing goals to reflect your current needs.

Modifying a Goal

To modify a goal, navigate to the savings goals section. Select the goal you wish to update. You can then adjust the target amount, deadline, or goal name. Once you’ve made the desired changes, save your updates.

Deleting a Goal

If you no longer need a specific goal, you can delete it. Locate the goal you wish to remove in the savings goals section. Select the goal and choose the delete option. Be aware that deleting a goal is permanent and cannot be undone. Any progress made towards the goal will be incorporated back into your main savings balance.

Tips for Staying on Track

Staying motivated and committed to your savings goals requires consistent effort. Here are some tips to help you stay on track:

Set Realistic Goals

Ensure your savings goals are achievable within your current financial situation. Setting realistic expectations prevents discouragement and increases your likelihood of success.

Automate Your Savings

Leverage the automation features within your banking app. Set up recurring transfers to automatically move funds into your savings account on a regular schedule. This consistent approach makes saving effortless.

Track Your Progress

Regularly monitor your progress. Your banking app provides tools to visualize your savings growth. Tracking your progress helps maintain momentum and provides a visual reminder of your achievements.

Review and Adjust

Periodically review your savings goals and adjust them as needed. Life changes and financial circumstances can evolve. Adapting your goals ensures they remain relevant and attainable.