Closing a digital bank account might seem straightforward, but ensuring it’s done safely and securely requires careful consideration. This guide provides a comprehensive step-by-step process on how to close your digital bank account, protecting your financial information and avoiding potential issues. Whether you’re switching to a new digital bank, transitioning to a traditional brick-and-mortar institution, or simply consolidating your finances, understanding the proper procedure is crucial. Learn how to navigate the process of closing your online bank account with confidence.

From verifying zero balance requirements and transferring remaining funds to confirming account closure with your digital banking provider, this article covers all the essential steps. We’ll address common concerns, such as handling recurring transactions, managing linked accounts, and downloading your transaction history for your records. Taking the necessary precautions when closing your digital bank account ensures a smooth transition and minimizes the risk of future complications. Read on to discover the best practices for closing your digital bank account safely.

Reasons for Closing Your Account

There are various reasons why you might choose to close your digital bank account. Understanding these reasons can help you determine if closing your account is the right decision for you.

Common Reasons

-

Switching Banks: You may find a different bank that offers better interest rates, lower fees, or features more aligned with your financial needs.

-

Dissatisfaction with Service: Experiencing poor customer service, technical issues, or security concerns can lead to account closure.

-

Consolidating Accounts: You might simplify your finances by consolidating multiple accounts into a single, more manageable account.

-

Account Inactivity: If you are no longer using the account, closing it can help avoid potential fees or security risks.

-

Relocation: Moving to a different country or region may necessitate closing your account if the bank doesn’t operate in that area.

Less Common Reasons

Other less frequent reasons include identity theft or fraudulent activity on the account, or simply a change in personal financial strategies.

Withdrawing Remaining Balance

Before initiating the account closure process, it is crucial to withdraw any remaining balance. There are several ways to accomplish this.

Methods for Withdrawing Your Balance

-

Transfer to another account: The most common method is to transfer your remaining funds to another bank account you own.

-

Withdrawal to a linked debit card: If your digital bank account has a linked debit card, you can withdraw the remaining funds via ATM.

-

Request a check or bank draft: Some digital banks offer the option to issue a check or bank draft for your remaining balance.

Verify your account balance is zero after completing the chosen withdrawal method to avoid complications during the closure process. Contact your digital bank’s customer support if you encounter any issues with withdrawing your balance.

Cancelling Scheduled Payments

Before closing your digital bank account, it’s crucial to cancel any scheduled payments or automatic transactions linked to it. This includes bill payments, subscriptions, and recurring transfers.

Failing to cancel these beforehand can result in declined payments, late fees, and potential disruptions to your services. Identify all active scheduled payments. Your account transaction history is a good place to start.

Most digital banking platforms provide options to cancel scheduled payments directly within the app or website. Look for a section dedicated to “Bill Pay,” “Scheduled Payments,” or “Automatic Transfers.”

Contact the recipient or service provider directly to update your payment information with your new account details after your old account has been closed.

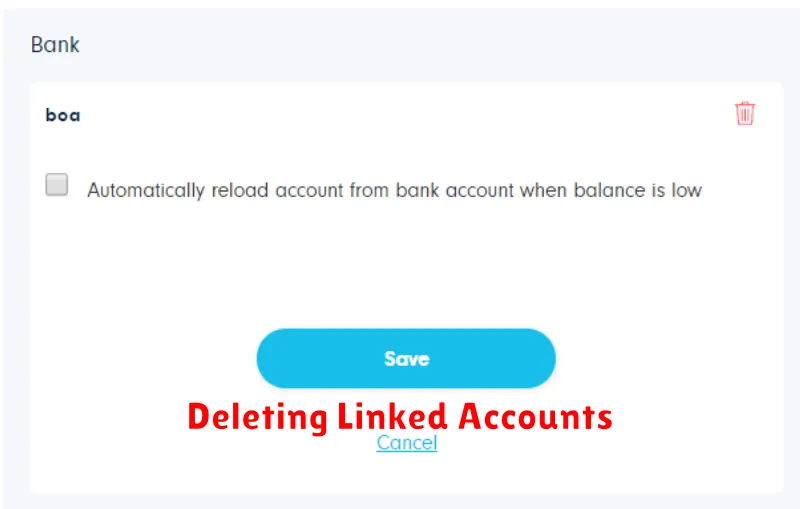

Deleting Linked Accounts

Before closing your digital bank account, it’s crucial to disconnect any linked accounts or services. This might include external bank accounts, investment platforms, or payment apps. Failure to do so could result in failed transactions or difficulties accessing funds in the future.

Begin by identifying all linked accounts. Your digital bank’s website or app should provide a list of connected services. Carefully review this list to ensure you haven’t overlooked any connections.

Next, follow the procedures outlined by your digital bank to delink each account. This process may vary depending on the specific service. Some may require you to delink directly through the third-party platform.

Verify the removal of each linked account after completion. This confirms that no active connections remain and helps prevent future complications.

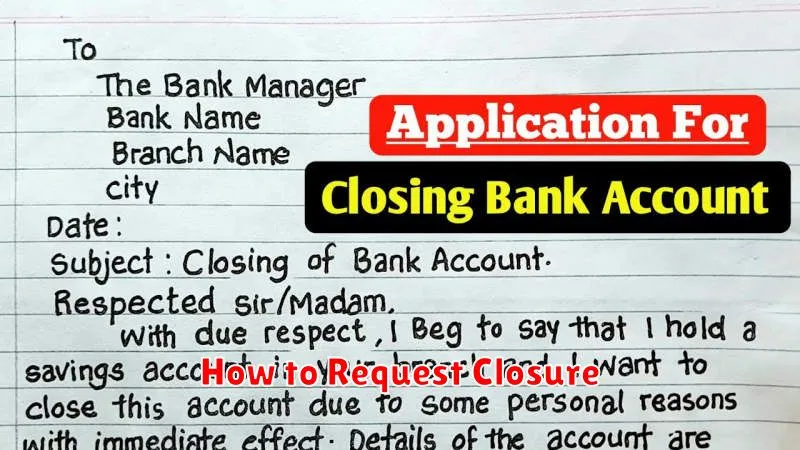

How to Request Closure

The process for closing your digital bank account may vary slightly depending on the specific institution. However, there are some common steps you can expect to follow. Always refer to your bank’s specific instructions for the most accurate information.

Typically, you can initiate closure through the following methods:

- In-app closure: Many digital banks allow account closure directly through their mobile app. Look for an option within the settings or account management section.

- Secure messaging: Contact customer support through the secure messaging feature within the app or website. Request account closure and follow their instructions.

- Email: Send a formal email to the bank’s customer service address, clearly stating your request to close your account. Be sure to include all relevant account information.

- Phone: In some cases, you may be able to request closure by calling customer support. Be prepared to verify your identity and account details.

Before initiating closure, ensure you have zeroed out your balance and transferred any remaining funds to another account.

Confirmation and Final Records

Once you’ve completed the account closure process, it’s crucial to obtain confirmation. This typically comes in the form of an email or a notification within your online banking portal. Carefully review this confirmation for key details such as the closure date and any remaining balance information.

Maintaining final records is a vital step. Download and save any important documents associated with your account. This might include monthly statements, transaction histories, or closure confirmations. These records can be invaluable for tax purposes or resolving any future discrepancies.