Digital bank accounts offer a convenient and modern approach to managing finances. However, like traditional bank accounts, they often come with certain limits. Understanding these digital bank account limits is crucial for effectively managing your money and avoiding potential issues. This article will explore the various types of limits you might encounter with a digital bank account, including transaction limits, deposit limits, and withdrawal limits. We will also discuss the reasons why these limits exist and how they can impact your banking experience.

Navigating the world of digital banking requires a clear understanding of its parameters. Knowing the specific limits associated with your digital bank account can help you avoid declined transactions, unexpected fees, and other inconveniences. From daily transaction limits to monthly deposit limits, being informed empowers you to make the most of your digital banking experience. This article provides a comprehensive overview of common digital bank account limits, helping you make informed decisions and manage your finances effectively within the digital banking landscape.

Types of Account Limits

Digital bank accounts often come with various limits that impact how you use them. Understanding these limits is crucial for managing your finances effectively.

Generally, account limits fall into a few key categories:

Transaction Limits

These restrict the amount of money you can send or receive within a specific timeframe. Common transaction limits include:

- Daily Limit: The maximum amount you can transact in a single day.

- Weekly Limit: The maximum amount you can transact in a single week.

- Monthly Limit: The maximum amount you can transact in a single month.

- Per-Transaction Limit: The maximum amount allowed for a single transaction.

Balance Limits

Some digital banks impose limits on the maximum balance you can hold in your account. This is less common than transaction limits.

Withdrawal Limits

These limits dictate how much money you can withdraw from your account, typically through ATMs or other methods.

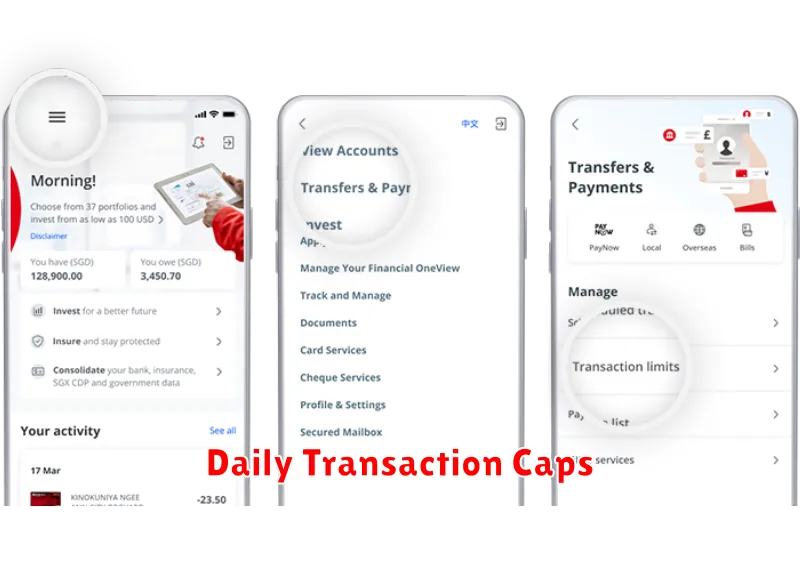

Daily Transaction Caps

Daily transaction caps are limits imposed on the total monetary value of transactions you can perform within a 24-hour period. These limits are distinct from other account limitations, such as balance caps or withdrawal limits.

The purpose of daily transaction caps is primarily for security. By limiting the amount that can be transferred out of an account each day, banks can mitigate potential losses due to fraud or unauthorized access.

These limits are often customizable. Contact your bank to discuss adjusting your daily transaction limit. Be prepared to provide justification for a higher limit.

Factors influencing daily transaction caps can include your account type, transaction history, and the bank’s own internal policies.

ATM Withdrawal Restrictions

ATM withdrawal restrictions are common limitations placed on digital bank accounts regarding the amount of cash you can withdraw from an ATM within a specific timeframe. These restrictions can vary significantly between banks and account types. Understanding these limits is crucial for managing your finances effectively.

Common restrictions include:

- Daily Withdrawal Limit: This is the maximum amount you can withdraw in a single day.

- Transaction Limit: This refers to the number of ATM withdrawals you are allowed per day.

- Weekly Withdrawal Limit: This is the maximum amount you can withdraw over the course of a week.

These limits are often set to protect both the bank and the customer from potential fraud and excessive spending. Exceeding these limits can result in declined transactions or additional fees. It’s important to review your bank’s specific terms and conditions to understand your account’s withdrawal restrictions.

How to Increase Limits

Digital bank account limits, such as transaction and balance limits, can often be increased. The process varies depending on the specific bank and the type of limit you wish to raise. Contacting customer support is typically the first step. They can guide you through the necessary procedures.

Some banks allow limit increases directly through their mobile app or website. This usually involves verifying your identity and providing additional information. Commonly requested information includes proof of income, address verification, and reasons for the requested increase. A strong transaction history with the bank can also contribute to a successful limit increase.

In some cases, upgrading to a premium account tier may automatically increase certain limits. Review the features and benefits of different account types offered by your bank to explore this option.

Temporary vs Permanent Limits

Digital bank accounts often employ both temporary and permanent limits on transactions. Understanding the distinction is crucial for managing your finances effectively.

Permanent limits are typically set during account opening and remain unchanged unless you specifically request an adjustment. These limits relate to fundamental aspects of your account, such as daily or monthly transfer maximums. For example, your account might have a permanent daily transfer limit of $5,000.

Temporary limits, on the other hand, are dynamic and can be implemented for various reasons, including security concerns, fraud prevention, or account-specific issues. These limits might be triggered by unusual activity, such as a sudden large transaction or a change in your login location. Temporary limits are generally shorter-term and can often be resolved by contacting customer support.

Being aware of both permanent and temporary limitations allows you to anticipate potential transaction restrictions and avoid disruptions in your financial activities.

When to Contact Support

While digital banking offers convenience and flexibility, certain situations may require you to contact customer support regarding your account limits. Reaching out to support ensures you receive prompt assistance and accurate information tailored to your specific needs.

Consider contacting support in the following scenarios:

- You are approaching your transaction limit and require a temporary increase.

- You believe your account limits are incorrect or unexpectedly low.

- You need clarification regarding a specific limit policy.

- You have encountered an error message related to account limits.

- You wish to request a permanent limit increase.

By contacting support in these situations, you can address limit-related concerns efficiently and maintain seamless access to your digital banking services.