Navigating finances as an international student can be complex, especially when dealing with different currencies and banking systems. Digital banks offer a modern, convenient solution to these challenges. For students studying abroad, digital banking provides a streamlined way to manage money, send and receive international payments, and access financial services with ease. This article will explore the advantages of using digital banks for international students, highlighting their key features and benefits. Learn how digital banks can simplify your financial life, reduce international transaction fees, and provide accessible banking solutions while you’re studying abroad.

Traditional banks often present hurdles for international students, including stringent documentation requirements, high international transaction fees, and limited accessibility. Digital banks offer a compelling alternative, providing user-friendly mobile apps, multi-currency accounts, and often significantly lower fees. Understanding the benefits and drawbacks of using digital banks for international students is crucial for making informed financial decisions. This article will delve into the specifics of how digital banking can help international students manage their finances effectively, offering insights into choosing the right digital bank and maximizing its features for a seamless financial experience while studying abroad.

Opening Accounts from Abroad

Opening a digital bank account from your home country before arriving can simplify your transition to studying abroad. Pre-arrival account setup often allows you to transfer funds, pay initial expenses, and manage your finances seamlessly upon arrival.

Eligibility requirements vary between digital banks and countries. Some banks may require a valid student visa or proof of enrollment at a recognized institution. Researching specific bank policies in advance is crucial.

The application process typically involves completing an online form and providing required documentation such as your passport and proof of address. Some digital banks may conduct video verification for identity confirmation.

Receiving Funds from Home

Digital banks can simplify receiving funds from home, eliminating the complexities often associated with traditional international transfers.

Reduced Fees and Faster Transfers: Compared to traditional banks, digital banks often offer significantly lower fees and faster transfer speeds. This makes receiving smaller, more frequent payments from home more practical.

Multiple Currency Support: Many digital banks support multiple currencies, allowing students to receive funds directly in their local currency, eliminating the need for costly currency exchanges. This can also simplify budgeting and expense tracking.

Transparency and Control: Digital banking platforms typically provide real-time transaction updates and notifications, giving students greater control and visibility over their finances. They can easily track incoming transfers and monitor their account balance.

Multi-Currency Features

A key advantage of digital banks for international students is their multi-currency capabilities. These features can significantly simplify managing finances across borders and potentially save money on foreign transaction fees.

Many digital banks offer accounts that can hold and transact in multiple currencies. This means students can receive money from their home country in their local currency and then spend in their host country’s currency without needing to exchange funds through traditional and often expensive channels.

Currency conversion is often facilitated within the app at competitive exchange rates. Some digital banks even offer a debit card that automatically detects and uses the correct currency, further streamlining transactions.

This functionality minimizes the hassle of managing separate bank accounts and reduces the risk of fluctuating exchange rates impacting funds. Be sure to compare the specific multi-currency features and fees associated with different digital banks to find the best fit for your needs.

Tuition and Living Expense Payments

Digital banks offer a convenient and often cost-effective way for international students to manage their finances while studying abroad. These banks frequently provide features tailored to the needs of international students, such as multi-currency accounts and low or no international transaction fees.

Tuition payments can often be made directly through the digital bank’s platform, sometimes even facilitating international transfers directly to the educational institution. This can simplify the payment process and potentially reduce associated bank charges. Always confirm accepted payment methods with your institution.

For living expenses, digital banks offer easy access to funds through debit cards and mobile applications. This allows students to manage their daily spending, pay bills, and withdraw cash conveniently. Some digital banks also offer budgeting tools to help students track their expenses and stay within their budget.

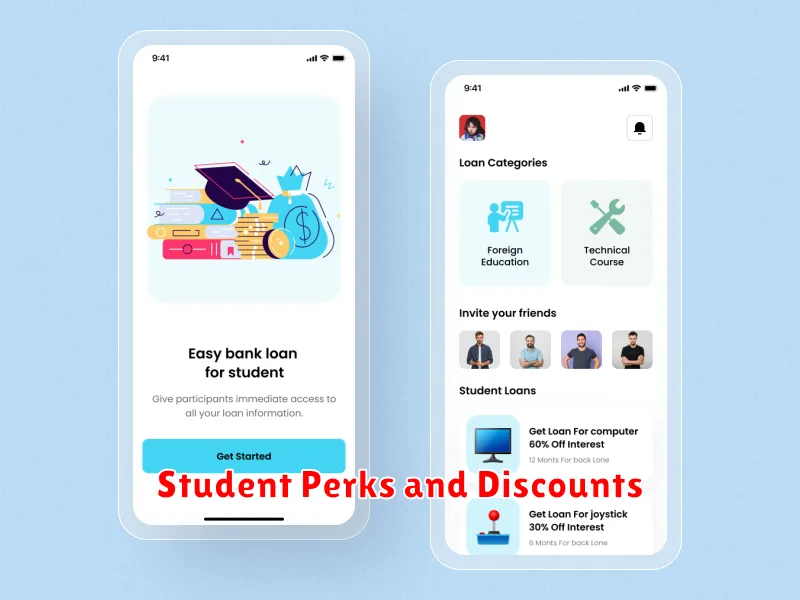

Student Perks and Discounts

Many digital banks recognize the unique financial needs of students and offer tailored perks and discounts. These can significantly ease the burden of managing finances while studying abroad.

Common student benefits include discounted or waived monthly fees, free international money transfers, and preferential exchange rates. Some digital banks also partner with businesses to offer exclusive student discounts on goods and services like transportation, entertainment, and food.

When choosing a digital bank, carefully compare the available student perks. The value of these benefits can vary greatly, and selecting the right bank can result in substantial savings.

Closing Account after Graduation

After graduation, international students may need to close their digital bank accounts due to changing residency status or lack of continued eligibility. It’s crucial to understand the account closure process to avoid potential fees or complications.

Typically, closing a digital bank account involves the following steps:

- Withdraw all remaining funds. Ensure your account balance is zero or transfer the remaining amount to another account.

- Contact customer support. Inform the bank of your intention to close the account and inquire about specific procedures or documentation requirements.

- Confirm closure. Obtain confirmation from the bank that the account has been successfully closed. Keep records of this confirmation for future reference.

Some digital banks may have specific requirements for closing accounts held by non-residents. It’s essential to contact your bank directly and follow their instructions carefully.