Managing finances effectively is crucial for the success of any small business. In today’s digital age, leveraging the right digital banking features can significantly streamline operations, improve financial control, and ultimately boost profitability. This article will explore the top digital bank features for small businesses, highlighting their benefits and how they can contribute to a more efficient and successful business operation. We’ll delve into the key aspects to consider when choosing a digital bank and how these features can help you manage your finances more effectively.

From online payment processing and mobile banking to automated accounting and real-time financial reporting, digital banking offers a wealth of tools designed specifically for the needs of small businesses. Understanding which digital banking features are most valuable to your specific business is essential for maximizing efficiency and growth. This article will guide you through the essential digital bank features, empowering you to make informed decisions and optimize your financial management strategy. By exploring these digital bank features for small businesses, you can unlock new opportunities to streamline operations and achieve your financial goals.

Multiple User Access

Multiple user access is a crucial feature for small businesses. It allows various team members to access and manage the business’s finances. This streamlines operations and improves collaboration.

This feature often comes with customizable permission levels. Business owners can control which employees have access to specific functions, such as viewing transactions, making payments, or managing payroll. This granular control enhances security and prevents unauthorized access.

Benefits of multiple user access include:

- Improved efficiency: Multiple users can work simultaneously, speeding up tasks.

- Better collaboration: Real-time access to financial data facilitates better communication and decision-making.

- Enhanced security: Customizable permissions ensure that sensitive information is protected.

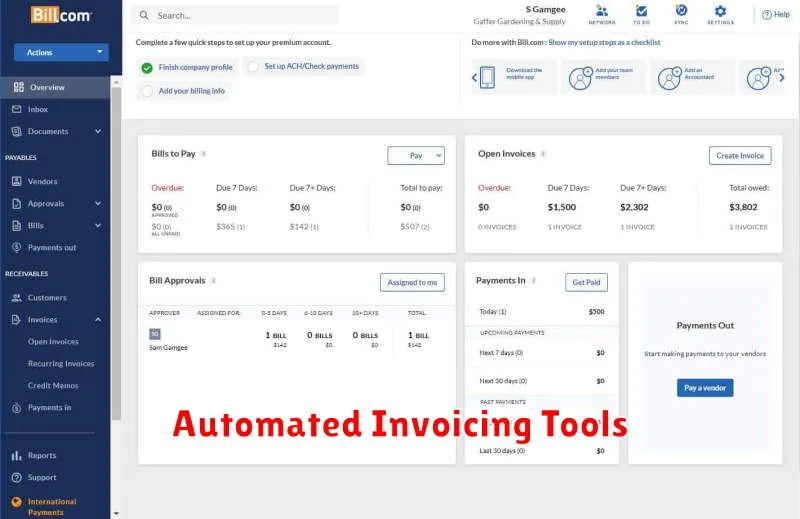

Automated Invoicing Tools

Automated invoicing is a crucial feature for small businesses. It streamlines the billing process, saving time and reducing errors. This feature allows businesses to generate and send invoices automatically, often based on predefined schedules or triggers.

Key benefits include improved cash flow through timely invoicing and reduced administrative overhead. Automated invoicing tools often integrate with other accounting software, further simplifying financial management.

Features to look for include:

- Customizable invoice templates

- Automated payment reminders

- Recurring billing options

- Integration with payment gateways

By automating this critical task, small businesses can free up valuable time to focus on core operations and growth.

Real-Time Cash Flow Reports

Real-time cash flow reports are a crucial feature for small businesses. This functionality allows business owners to monitor incoming and outgoing funds instantly. This immediate access to financial data facilitates more informed and proactive decision-making.

Instead of waiting for monthly or quarterly statements, businesses can track daily transactions, identify trends, and anticipate potential shortfalls or surpluses. This empowers owners to optimize spending, manage debts effectively, and capitalize on growth opportunities.

Key benefits include:

- Improved Forecasting: Real-time data enables more accurate financial projections.

- Enhanced Budgeting: Up-to-the-minute insights allow for dynamic budget adjustments.

- Faster Decision Making: Immediate awareness of cash flow status supports prompt action.

Expense Categorization

Effective expense management is crucial for small businesses. Digital banking platforms often include automated expense categorization features that streamline this process. These features automatically categorize transactions based on merchant codes and spending patterns, significantly reducing manual data entry.

Automated categorization saves time and allows business owners to quickly analyze spending trends. This provides valuable insights into where money is being spent and allows for better budget allocation. Some platforms also allow users to customize categorization rules for more precise tracking.

With a clear view of expenses categorized by type (e.g., marketing, rent, supplies), business owners can make data-driven decisions to optimize spending and improve profitability.

Business Account Integration

Seamless integration with existing business accounting software is a crucial feature for digital banking platforms catering to small businesses. This integration streamlines financial management by automating tasks such as transaction reconciliation and reporting.

Key benefits of this integration include:

- Real-time financial data synchronization: Eliminates manual data entry and ensures accuracy.

- Automated reconciliation: Reduces time spent on reconciling transactions.

- Simplified reporting: Provides readily available financial reports for informed decision-making.

Look for digital banks that integrate with popular accounting software platforms. This integration can significantly improve efficiency and provide a clearer financial overview for your business.

Easy Tax Document Export

Simplified tax preparation is a key benefit of modern digital banking. The ability to quickly and easily export relevant financial data can save small business owners valuable time and resources.

Look for features that allow you to export transactions in various formats compatible with popular tax software. CSV and Excel exports are commonly supported formats. Some banks might even offer direct integration with tax preparation platforms. This streamlined process eliminates manual data entry and reduces the risk of errors.

Being able to filter transactions by date range, category, or payment type is another valuable feature. This targeted export allows you to quickly gather the precise data needed for specific tax forms or schedules.

Secure export options are also crucial. Ensure the platform utilizes secure methods for downloading your sensitive financial information.