Managing your finances effectively often requires quick action. Whether you suspect fraudulent activity, misplace your card, or simply want to restrict spending, knowing how to freeze and unfreeze your credit and debit cards instantly is crucial. This article provides a comprehensive guide on how to freeze and unfreeze your cards across various platforms, empowering you to take control of your financial security. Learn the steps to instantly freeze your cards, preventing unauthorized transactions, and how to unfreeze them just as quickly when you’re ready to use them again.

In today’s fast-paced world, immediate access to card management tools is essential. This guide will walk you through the process of freezing and unfreezing your cards instantly via mobile apps, online banking portals, and phone calls. We will cover various financial institutions and their specific procedures, providing you with the knowledge to freeze your cards instantly in any situation. Understanding how to unfreeze your cards is equally important, and we’ll explain that process as well. Protect your finances by mastering the ability to freeze and unfreeze your cards instantly.

When You Should Freeze a Card

Freezing a card provides a crucial layer of security against unauthorized use. You should consider freezing your card in the following situations:

Suspected or Confirmed Compromise

If you suspect your card information has been stolen or compromised, freezing it immediately prevents potential fraudulent transactions. This is especially important if you’ve lost your card or noticed unusual activity on your account.

Unusual Account Activity

Any unauthorized or suspicious transactions warrant an immediate card freeze. This allows you to investigate the activity and prevent further unauthorized charges.

Lost or Stolen Card

Freezing your card when it’s lost or stolen is the first step in protecting yourself from fraud. It prevents anyone else from using the card, even if they have the physical card in their possession.

Protecting Unused Cards

Even if you don’t actively use a card, freezing it provides an extra layer of security. This prevents unauthorized use should your card information become compromised through data breaches or other means.

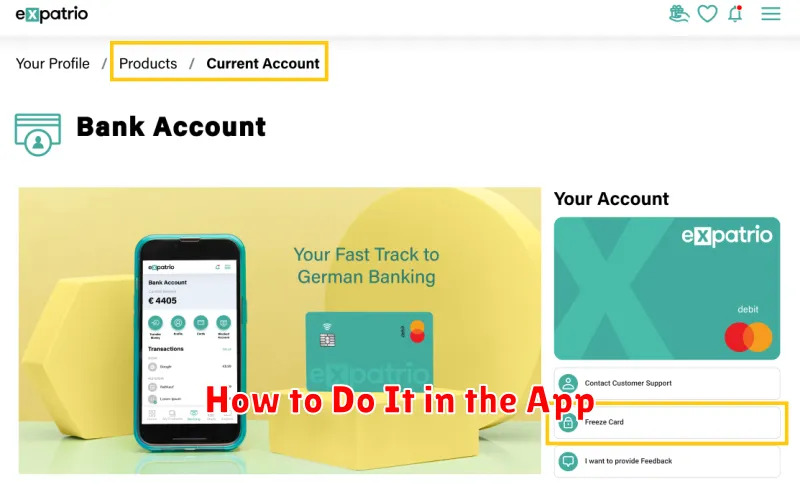

How to Do It in the App

Freezing and unfreezing your cards within the app is a straightforward process. Follow these steps to manage your card security instantly.

Freezing Your Card

First, log in to the app using your credentials. Once logged in, navigate to the “Cards” section. Locate the card you wish to freeze and select it. You will then see an option to “Freeze Card”. Confirm your selection, and your card will be frozen immediately.

Unfreezing Your Card

To unfreeze your card, follow the same initial steps. Log in, navigate to the “Cards” section, and select the frozen card. You will find the option to “Unfreeze Card.” Select this option, and your card will be ready to use again.

Unfreezing Within Seconds

Thawing your card is just as swift as freezing it. Most banking apps and websites offer an “unfreeze” or “activate” option. Simply locate this feature, often found in the same area as the “freeze” option, and select it. Verification may be required, usually in the form of your password, fingerprint, or facial recognition.

The unfreezing process typically takes mere seconds. Once completed, your card will be ready to use immediately for all transactions. No further action is necessary on your part.

Temporary Freezes for Misplaced Cards

Misplacing your card can be a stressful experience. A temporary freeze offers a quick solution to protect your account while you search. This feature allows you to block transactions without fully canceling your card. It’s a convenient, reversible option ideal for those moments when you’re unsure if your card is truly lost or simply misplaced.

Most financial institutions offer temporary freezes through their mobile banking apps or online banking portals. The process typically involves logging into your account and navigating to the card management section. You should find a clear option to “freeze” or “temporarily block” your card. Once frozen, the card cannot be used for purchases, ATM withdrawals, or online transactions.

It’s important to remember that a temporary freeze is different from canceling your card. When you find your card, you can simply unfreeze it using the same method you used to freeze it. This immediate reactivation allows you to resume using your card without the need for a replacement.

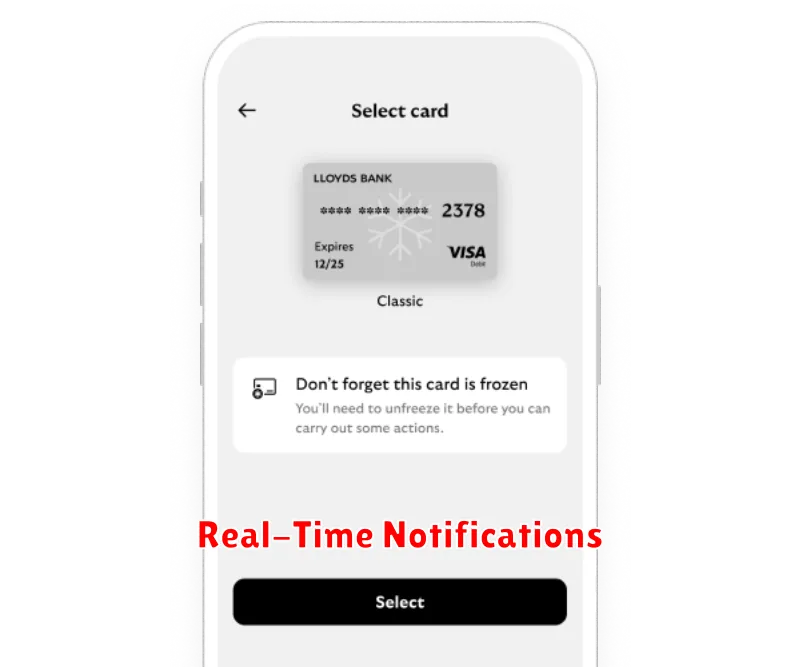

Real-Time Notifications

Receive instant notifications about card activity. This ensures you are aware of every transaction and can quickly identify any unauthorized use.

These real-time alerts can be customized to your preferences. You might opt to receive notifications for all transactions, or only for specific activities such as:

- Card freezes and unfreezes

- Purchases above a certain amount

- Declined transactions

- International transactions

These notifications typically arrive via push notifications on your mobile device, or through email or SMS message. This allows you to react swiftly to any suspicious activity and take appropriate action.

Preventing Unauthorized Use

Freezing your cards is a proactive measure to prevent unauthorized use if your card is lost or stolen. By temporarily deactivating your card, you effectively block any transactions from being processed, providing you with peace of mind and financial security.

Even if you merely suspect unusual activity, freezing your card is a wise precaution. This swift action can prevent potential fraud before it escalates. Once you locate your card or determine there was no unauthorized access, you can conveniently unfreeze it and resume regular usage.

Freezing your cards adds an extra layer of security beyond basic card protection measures. While strong passwords and careful online practices are crucial, freezing your cards provides an immediate and effective way to mitigate risk in uncertain situations.