In today’s fast-paced world, the need to send and receive money instantly has become paramount. Whether it’s splitting a bill with friends, paying for goods and services, or transferring funds to family members across the globe, the ability to conduct instant money transfers is essential for individuals and businesses alike. This article will explore the various methods available for sending and receiving money instantly, highlighting the benefits and drawbacks of each approach. We’ll delve into the security measures employed by these platforms, ensuring your transactions remain safe and secure, and discuss the future of instant money transfers in an increasingly digital landscape.

Navigating the world of instant money transfers can be daunting, with a multitude of options vying for your attention. From traditional bank transfers to cutting-edge mobile payment applications, understanding the nuances of each method is crucial for making informed decisions. Are you looking for the fastest way to send money? Perhaps security is your top priority, or maybe you’re seeking the most cost-effective solution. This article will equip you with the knowledge you need to choose the instant money transfer method that best suits your unique requirements, empowering you to manage your finances efficiently and effectively in the digital age. We will cover topics including peer-to-peer (P2P) payment apps, online banking transfers, and specialized international money transfer services, providing a comprehensive overview of the instant money transfer ecosystem.

Using Bank Apps for Transfers

Bank apps have become a primary tool for managing finances, including sending and receiving money instantly. These apps offer a convenient and efficient alternative to traditional methods like visiting a branch or using ATMs.

Most banking apps allow transfers between accounts within the same bank and to external accounts at other financial institutions. Key features usually include scheduling payments, setting up recurring transfers, and reviewing past transaction history.

Security is a crucial aspect of bank app transfers. Features like multi-factor authentication and biometric logins add layers of protection to prevent unauthorized access. Always ensure your app is up-to-date and be wary of phishing attempts.

Before using a bank app for transfers, familiarize yourself with any applicable fees or transfer limits. Some banks may impose restrictions on the amount or frequency of transfers.

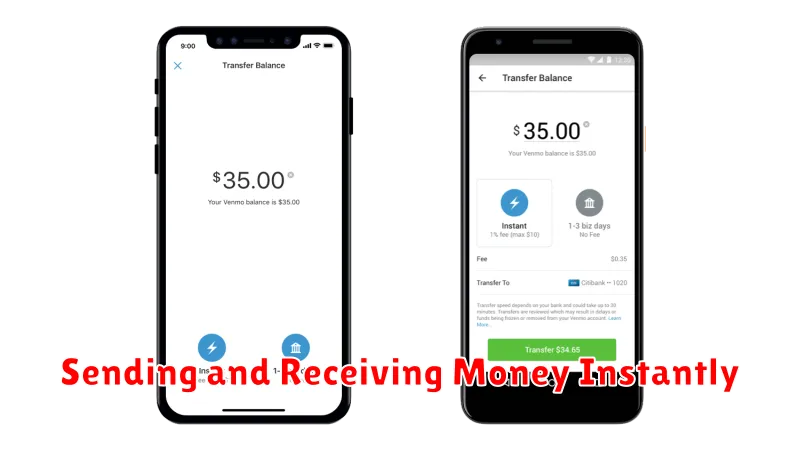

Peer-to-Peer Payment Options

Peer-to-peer (P2P) payment services offer a convenient way to send and receive money instantly. These platforms typically link directly to a user’s bank account or debit card, enabling quick transfers. Security is a primary concern, and reputable services utilize encryption and fraud detection measures to protect users.

Several popular P2P platforms are available, each with its own features and fee structures. Choosing the right service depends on individual needs and preferences. Factors to consider include transaction fees, transfer speed, and availability on different operating systems.

When using P2P services, it’s essential to be mindful of potential scams. Verify the recipient’s identity before sending money and avoid using these platforms for transactions with unknown individuals.

No Hidden Fees

We believe in transparent and straightforward pricing. That’s why we don’t charge any hidden fees when you send or receive money. You’ll see exactly what the cost is upfront, so there are no surprises.

What you see is what you get. Our fees are clearly displayed before you confirm your transfer. This allows you to make informed decisions and budget accordingly.

Whether you’re sending a small amount or a large sum, you can rest assured knowing you won’t be hit with unexpected charges. We are committed to providing a cost-effective and reliable money transfer service.

Cross-Border Capabilities

International money transfers have traditionally been a complex and time-consuming process. However, advancements in financial technology are rapidly changing this landscape.

Our platform offers robust cross-border capabilities, allowing you to send and receive money instantly across borders. We leverage a secure and efficient network to facilitate these transactions, minimizing delays and reducing costs.

Supported Countries/Regions:

- North America

- Europe

- Asia Pacific

We understand the importance of transparency in cross-border transactions. Our platform provides clear and upfront information regarding exchange rates and any applicable fees. You can rest assured that there are no hidden charges.

Requesting Payments Easily

Requesting payments should be a seamless and straightforward process. Modern financial tools simplify this process, enabling you to request funds quickly and efficiently.

Typically, requesting a payment involves specifying the amount owed, the recipient’s information, and the reason for the payment. Many platforms offer options for adding a due date and even automated reminders.

Some common methods for requesting payments include using peer-to-peer payment apps, invoicing software, or simply sending a payment request through your bank’s online platform. Choosing the right method depends on your specific needs and the nature of the transaction.

Key features to consider when selecting a payment request method include:

- Security: Ensure the platform utilizes strong security measures to protect your financial information.

- Speed: Choose a method that allows for quick and efficient transfer of funds.

- Convenience: Opt for a platform that is user-friendly and accessible on multiple devices.

- Fees: Be aware of any transaction fees associated with the service.

Security Measures for Transfers

Security is paramount when transferring money instantly. We employ multiple measures to protect your transactions.

Encryption: All transfers are secured with robust encryption, safeguarding your financial data from unauthorized access.

Two-Factor Authentication (2FA): 2FA adds an extra layer of security, requiring a second form of verification, such as a one-time code sent to your mobile device, in addition to your password. This helps prevent unauthorized access even if your password is compromised.

Fraud Monitoring: Our sophisticated fraud monitoring system constantly analyzes transactions for suspicious activity. We employ real-time monitoring and machine learning algorithms to detect and prevent fraudulent transfers.

Account Verification: We utilize various methods to verify account ownership, ensuring transfers are initiated and received by legitimate users.