In today’s fast-paced digital world, managing finances efficiently is paramount. Juggling multiple bank accounts across various institutions can be a cumbersome and time-consuming process. Fortunately, the advent of innovative banking apps now allows users to consolidate and manage multiple accounts within a single, unified platform. This simplifies financial oversight, offering a centralized hub for tracking balances, transactions, and transfers. Whether you’re managing personal checking and savings accounts, business accounts, or even accounts at different banks, learning how to manage multiple accounts in one banking app can significantly streamline your financial life.

This article will delve into the advantages and practicalities of managing multiple accounts in one banking app. We will explore the key features to look for when choosing an app that supports multiple accounts, discuss the security considerations involved, and provide a step-by-step guide on how to effectively link multiple accounts. By mastering these techniques, you can gain a comprehensive view of your finances, simplify money management, and ultimately, gain greater control over your financial well-being. Discover the convenience and efficiency of having all your financial information readily accessible at your fingertips.

Why Use One App for All?

Managing finances across multiple accounts can be a complex and time-consuming process. Juggling different login credentials, security protocols, and statement cycles can quickly become overwhelming. Using one banking app to manage all your accounts offers a streamlined and efficient solution.

Consolidating your financial overview within a single application provides several key advantages. It allows for a holistic view of your financial standing, simplifying budgeting and tracking expenses. This centralized approach eliminates the need to switch between different apps or websites, saving you valuable time and effort.

Furthermore, a single app often offers enhanced security features, such as multi-factor authentication and biometric login, to protect all your accounts under one robust security umbrella. This simplifies security management compared to maintaining different security protocols for each individual account.

Linking Multiple Accounts Securely

Linking multiple accounts within a single banking app offers a centralized platform for managing finances. However, security is paramount. Our app employs robust security measures to protect your linked accounts.

Multi-Factor Authentication (MFA) is required for adding and accessing linked accounts. This adds an extra layer of security beyond your username and password.

We use encryption technology to protect your data both in transit and at rest. This ensures that your sensitive information remains confidential and secure.

Account linking is established through secure APIs with your other financial institutions. We adhere to strict security protocols and industry best practices.

Regular security assessments and penetration testing are conducted to identify and address potential vulnerabilities.

Viewing Balances in One Dashboard

Managing multiple accounts can be cumbersome, but with our banking app, you can view all your balances in one convenient dashboard. This feature provides a consolidated view of your financial standing, allowing you to quickly assess your overall financial health.

The dashboard displays each account with its current balance, clearly labeled for easy identification. This includes checking accounts, savings accounts, and any other eligible accounts you have linked to the app.

The dashboard is designed for at-a-glance access to your financial information. You can easily track spending and savings progress across all your accounts without needing to navigate to individual account summaries. This streamlined access empowers you to make informed financial decisions.

Transferring Between Linked Accounts

One of the primary advantages of managing multiple accounts within a single banking app is the ease of transferring funds between them. This streamlined process eliminates the need for separate logins or external transfers.

Typically, transferring funds involves selecting the source account (the account from which the money is being transferred) and the destination account (the account receiving the money). You then specify the amount to transfer.

Verification steps, such as confirming the transfer with a one-time passcode or biometric authentication, add an extra layer of security to the process.

Transfers are usually processed immediately, although some banks may have specific processing times depending on the type of accounts involved.

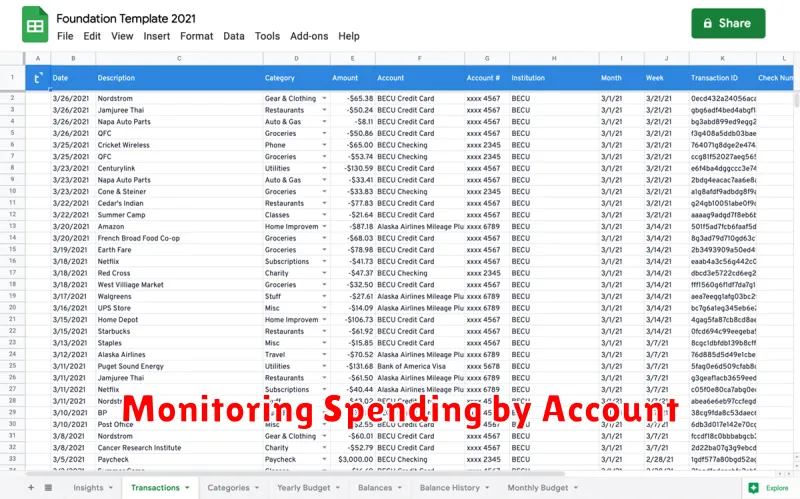

Monitoring Spending by Account

Effectively managing multiple accounts requires a clear overview of spending patterns for each account. Our app provides tools to monitor your spending by individual account, giving you granular control over your finances.

You can select a specific account to view detailed transaction history, including dates, amounts, and descriptions. This allows you to quickly identify spending trends and potential areas for improvement.

The app also offers visual representations of your spending, such as charts and graphs, to help you understand your spending habits at a glance. These visualizations can be filtered by account, providing a clear comparison of spending across your different accounts.

Regular monitoring of individual account spending enables you to stay within budget, identify irregularities, and make informed financial decisions.

Setting Alerts for Each Account

Managing multiple accounts often requires distinct alert settings for each. This allows you to monitor activity and balances effectively. Within the app, navigate to the “Alerts” or “Notifications” section. You should be able to select individual accounts and customize alerts for each.

Common alert types include low balance warnings, deposit notifications, and unusual activity alerts. You can typically define thresholds for balance alerts. For example, receive a notification when an account balance falls below $100. Deposit notifications inform you when funds are credited to your account. Unusual activity alerts can notify you of potentially fraudulent transactions.

It’s important to configure these alerts according to your specific needs. Carefully consider the types of alerts and the thresholds that will provide you with the most relevant and timely information.