In today’s interconnected world, mobile banking has become an indispensable tool for managing finances. The convenience of accessing accounts, transferring funds, and paying bills from anywhere, anytime, is undeniable. However, this convenience comes with inherent security risks. Understanding and implementing best practices for mobile bank login security is paramount to protecting your financial information and preventing unauthorized access. This article will explore essential strategies to fortify your mobile banking security posture, encompassing strong passwords, multi-factor authentication, and vigilance against phishing scams.

Navigating the complexities of mobile banking security can be daunting. From choosing a secure password to recognizing and avoiding phishing attacks, users must be proactive in safeguarding their accounts. This guide offers a comprehensive overview of best practices to enhance your mobile bank login security. By adopting these measures, you can significantly reduce the risk of compromise and maintain control over your financial well-being. Learn how to establish a secure mobile banking environment and protect yourself from evolving cyber threats.

Create Strong Passwords

Creating a strong and unique password is the first line of defense against unauthorized access to your mobile banking accounts. A weak password can be easily guessed or cracked by hackers, putting your financial information at risk.

Avoid using easily guessable information such as your name, birthdate, or pet’s name. Instead, aim for a password that is at least 12 characters long and includes a combination of uppercase and lowercase letters, numbers, and symbols.

Consider using a passphrase, which is a longer password made up of several words strung together. For example, “CorrectHorseBatteryStaple” is a strong passphrase that is relatively easy to remember but difficult to crack.

Do not reuse the same password across multiple accounts. If one account is compromised, all accounts using the same password become vulnerable. Use a unique password for each of your online accounts, especially your mobile banking app.

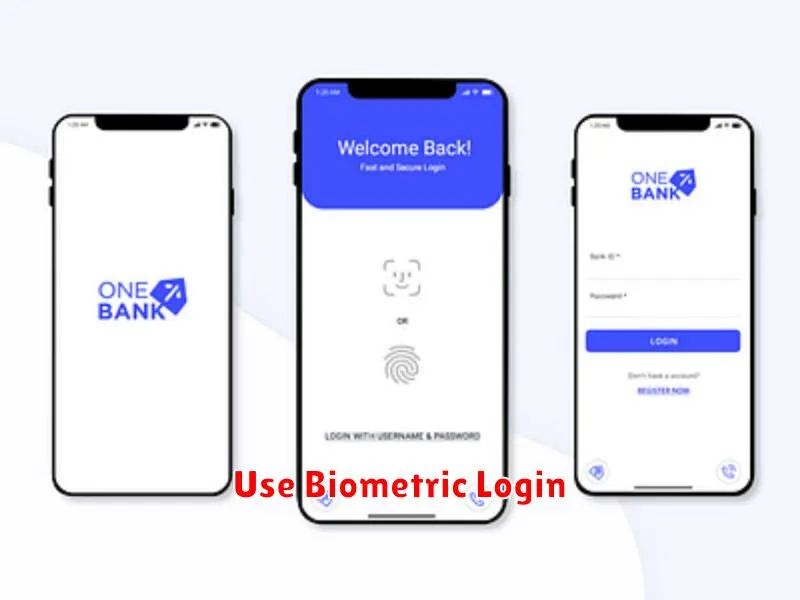

Use Biometric Login

Whenever available, enable biometric authentication, such as fingerprint or facial recognition, for accessing your mobile banking application. Biometrics offer a stronger layer of security compared to traditional passwords or PINs, as they are unique to each individual and harder to replicate.

While biometrics are generally secure, be aware of the specific security features of your device and the mobile banking app. Some devices have more robust biometric hardware and software than others. Understand any limitations, such as fallback methods (PIN, password) required in certain situations.

Avoid Public Wi-Fi

Public Wi-Fi hotspots are convenient, but they pose a significant security risk for mobile banking. These networks are often unsecured, meaning your data is not encrypted and is vulnerable to interception by hackers. Cybercriminals can use various techniques to eavesdrop on your activity, potentially gaining access to your login credentials, account details, and other sensitive information.

If you must use public Wi-Fi, take extra precautions. Consider using a virtual private network (VPN). A VPN encrypts your internet traffic, creating a secure connection even on an unsecured network. This adds a layer of protection, making it much harder for hackers to intercept your data.

Enable Login Alerts

Login alerts are a crucial security feature offered by most mobile banking apps. They provide real-time notifications of account access, allowing you to quickly identify and react to unauthorized login attempts. These alerts can be customized to your preference, typically offering notifications via email, SMS message, or push notifications directly through the app.

By enabling login alerts, you establish an early warning system against fraudulent activity. Receiving an alert for a login you didn’t initiate allows you to immediately contact your bank and take necessary steps to secure your account. This rapid response can be vital in mitigating potential financial losses.

It’s important to review the specific login alert settings within your mobile banking app. Pay close attention to the types of alerts offered and configure them to match your security needs. Consider enabling alerts for all login attempts, including successful and unsuccessful ones, to maintain maximum visibility over your account activity. This empowers you to monitor access patterns and detect any unusual behavior promptly.

Set Up Auto Logout

Auto logout is a critical security feature that automatically signs you out of your mobile banking app after a period of inactivity. This prevents unauthorized access if your device is lost or stolen. Enable this feature and set the timeout period to a short duration.

Most banking apps offer adjustable timeout periods. Consider a timeout of one minute or less. While a slightly longer timeout might offer convenience, a shorter duration significantly enhances security. The minor inconvenience of frequent logins is greatly outweighed by the substantial increase in protection against unauthorized transactions.

Configuring auto logout is usually straightforward. Navigate to the settings or security section of your mobile banking app. Look for options labeled “Auto Logout,” “Automatic Sign Out,” or similar. Select a short timeout duration, often presented in increments such as 15 seconds, 30 seconds, one minute, and five minutes. Choose the shortest option available for optimal security.

Update App Regularly

Regularly updating your mobile banking app is a critical security practice. Updates often include vital security patches that address newly discovered vulnerabilities. Failing to update leaves your device susceptible to attacks that exploit these weaknesses.

These updates not only patch security flaws but also often introduce enhanced security features, improving the overall protection of your financial information. Think of app updates as strengthening the lock on your digital vault.

Most mobile banking apps have automatic update settings. Ensure this feature is enabled in your device’s settings to receive updates promptly. If your app doesn’t have this functionality, make it a habit to manually check for updates regularly, preferably at least once a week.