Managing your finances effectively can be a challenge, especially with the ever-increasing complexity of modern banking. Fortunately, digital bank alerts offer a powerful tool to help you stay on top of your accounts and, more importantly, save money. These automated notifications provide real-time updates on your transactions, balances, and account activity, enabling you to monitor your spending, avoid costly fees, and identify potential fraudulent activity. This article will delve into the various types of digital bank alerts available and explain how they can be strategically utilized to achieve significant savings.

From low balance alerts that prevent overdraft charges to payment reminders that protect your credit score, the benefits of digital banking alerts are numerous. By proactively notifying you of important account information, these alerts empower you to make informed financial decisions and avoid unnecessary expenses. Discover how leveraging these readily available tools can transform your financial management and contribute to substantial savings over time.

Types of Smart Alerts

Digital banks offer a variety of smart alerts designed to help you manage your finances and save money. These alerts can be customized to your specific needs and preferences. Understanding the different types available allows you to leverage them effectively.

Balance Alerts: These are fundamental alerts that notify you when your account balance falls below or goes above a certain threshold. This helps you avoid overdraft fees and monitor your spending habits.

Payment Due Alerts: Never miss a payment again. Set up alerts to remind you of upcoming bill payments, credit card dues, or loan installments. This helps avoid late fees and maintain a good credit score.

Unusual Activity Alerts: These security-focused alerts notify you of suspicious transactions, such as large withdrawals or purchases made in unfamiliar locations. This provides an extra layer of protection against fraud.

Deposit Alerts: Get notified when funds are deposited into your account, such as your paycheck or a transfer from another account. This helps you track your incoming money and ensure everything is as expected.

Spending Limit Notifications

Spending limit notifications are a crucial feature offered by many digital banks. These alerts help you monitor your spending and avoid overspending. You can typically set limits on various categories, such as groceries, dining out, or online shopping.

When you approach or exceed your predefined limit, the digital bank sends you a notification. This real-time feedback allows you to make informed decisions about your purchases and adjust your spending habits accordingly. Notifications can be delivered via in-app messages, SMS, or email.

By utilizing spending limit notifications, you can gain better control over your finances and work towards your financial goals. This feature empowers you to stay within budget and avoid unnecessary expenses.

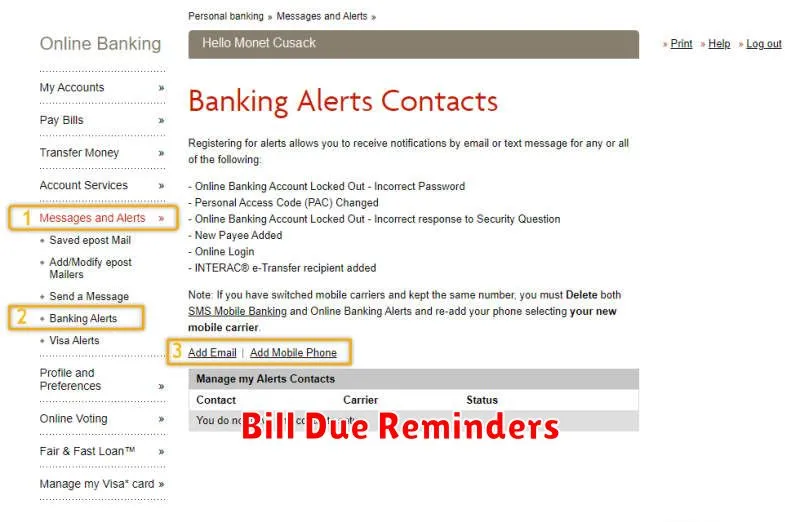

Bill Due Reminders

Bill due reminders are a cornerstone of digital banking alerts. These alerts notify you of upcoming payment deadlines for your various bills, such as credit cards, utilities, and loan payments. This helps you avoid late payment fees, which can significantly impact your finances.

You can typically customize these reminders, choosing the timing and delivery method (e.g., push notification, email, SMS). Some banks even allow you to set reminders for specific bill amounts or thresholds.

By proactively notifying you of upcoming due dates, bill payment reminders empower you to manage your finances effectively and minimize unnecessary expenses. This contributes to better financial health and peace of mind.

Unusual Activity Detection

Unusual activity detection is a crucial feature of digital banking that helps safeguard your finances. These systems monitor your transactions for suspicious patterns that deviate from your typical spending habits. This can include unusual purchase amounts, unfamiliar merchants, or transactions originating from unusual geographic locations.

When the system flags a potentially fraudulent activity, you’ll typically receive an immediate alert via email, SMS, or push notification through the bank’s mobile app. This allows you to quickly verify the transaction and take action if needed. Early detection can prevent significant financial losses and protect your account from unauthorized access.

Examples of unusual activity that might trigger an alert include:

- A large purchase significantly exceeding your average spending.

- Multiple transactions occurring in rapid succession.

- Transactions originating from a foreign country you haven’t visited.

- Purchases made with a compromised card.

Overdraft Prevention Alerts

Overdraft prevention alerts are crucial for maintaining a healthy financial balance. These alerts notify you when your account balance falls below a specified threshold, helping you avoid costly overdraft fees. They provide a real-time safety net, allowing you to take immediate action to prevent overdrafts.

You can typically customize the alert threshold to align with your spending habits. For example, you might set an alert for when your balance drops below $100. Receiving timely notifications gives you the opportunity to transfer funds, deposit money, or adjust your spending to avoid overdrawing your account.

These alerts can be delivered via various channels, including SMS text message, email, or push notifications through your bank’s mobile app. Choosing the right delivery method ensures you receive alerts promptly and conveniently.

Customizing Your Alert Settings

Tailoring your alert settings is crucial for maximizing the benefits of digital banking alerts. A well-configured alert system can provide timely notifications, helping you avoid unnecessary fees and manage your finances effectively. However, an overabundance of alerts can become overwhelming. This section explains how to customize your alerts to fit your specific needs.

Alert Categories

Most digital banking platforms allow you to customize alerts based on categories such as:

- Account Balance: Receive alerts for low balances, deposits, or when your balance reaches a specific threshold.

- Card Activity: Get notified of purchases, withdrawals, or declined transactions.

- Bill Payments: Set reminders for upcoming bill payments and confirmations when payments are processed.

- Security Alerts: Receive notifications for suspicious activity, login attempts, or password changes.

Within each category, you can often adjust the frequency and delivery method (e.g., push notifications, SMS, email) of the alerts.