In today’s rapidly evolving digital landscape, QR codes have emerged as a transformative technology, revolutionizing various sectors, most notably digital payments. The use of QR codes for payments provides a seamless and efficient alternative to traditional methods, offering enhanced convenience for both consumers and businesses. This article will delve into the mechanics of QR code payments, exploring their benefits, security features, and the overall impact they have on the modern financial ecosystem. Understanding how QR codes facilitate digital transactions is crucial for anyone navigating the increasingly digital world of commerce.

From small vendors to large corporations, businesses are increasingly adopting QR code payment systems due to their ease of implementation and cost-effectiveness. For consumers, paying with QR codes offers a streamlined, contactless experience, eliminating the need for physical cards or cash. This shift towards QR code-based digital payments signifies a major step towards a cashless society, offering faster transaction speeds, enhanced security measures, and improved accessibility. This article will provide a comprehensive overview of how QR codes are transforming the future of digital payments.

What Are QR Code Payments?

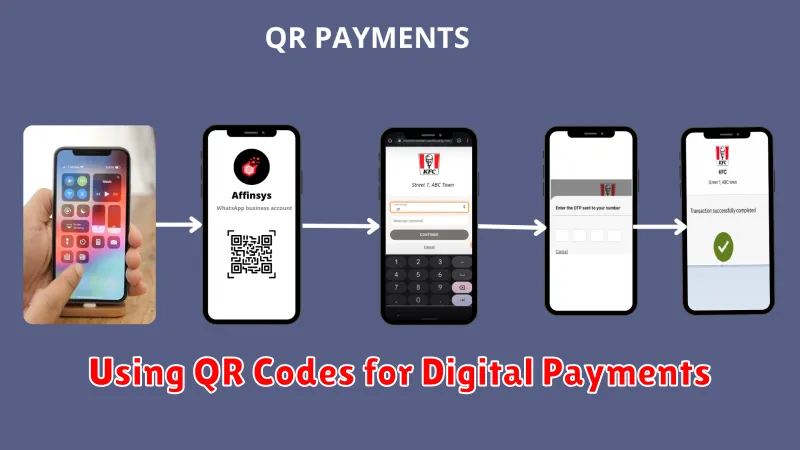

QR code payments are a contactless payment method where transactions are completed by scanning a Quick Response (QR) code displayed by a merchant. Customers use their smartphone or tablet’s camera or a dedicated QR code scanning app to read the code.

The QR code contains payment information such as the merchant’s identification, the transaction amount, and other relevant details. Once scanned, the customer’s payment app processes the transaction, often through a linked bank account, credit card, or digital wallet.

This method offers a fast and convenient alternative to traditional payment methods like cash or card payments, streamlining the checkout process for both customers and businesses.

How to Scan QR Codes

Scanning a QR code is a straightforward process. Most modern smartphones have built-in QR code scanning capabilities within their camera apps. Simply open your camera app and point it at the QR code. Ensure the entire code is visible within the frame. Your phone should automatically recognize and process the QR code.

If your device doesn’t have this functionality, numerous free QR code scanner apps are available for download. Once installed, open the app and follow the on-screen prompts, usually involving positioning the QR code within a designated frame on the app’s interface. The app will then interpret the code and display the embedded information.

Important Note: Always verify the information presented after scanning a QR code, especially when making a payment. Ensure the merchant name and payment amount are correct before proceeding. Be cautious of suspicious or unusually formatted QR codes.

Creating Your Own Payment QR

Generating a payment QR code typically involves using a payment gateway or a QR code generator that adheres to payment standards. These tools often require specific information to create a functional QR code.

Essential information often includes the merchant’s identification, the transaction amount, and a reference number. Some systems may also require additional details, such as the customer’s identifier or a description of the goods or services being purchased.

After inputting the required information, the generator creates the QR code, which can then be displayed physically or digitally. Customers can then scan this code with their smartphone’s camera or a dedicated QR code scanning application to initiate and complete the payment.

Important Considerations:

- Security: Ensure the chosen platform adheres to security best practices to protect sensitive financial information.

- Compatibility: Verify the generated QR code is compatible with commonly used payment apps in your target region.

- Testing: Thoroughly test the generated QR codes to ensure they function correctly before deploying them for customer use.

Supported Merchants and Platforms

QR code payments are accepted by a growing number of merchants and payment platforms. Acceptance varies by region and specific provider, but generally includes a wide range of businesses.

Major payment platforms often integrate QR code functionality, allowing users to link their accounts and make payments through their apps. These platforms commonly include popular digital wallets and online payment services.

In addition to large retailers, many smaller businesses and individual vendors are adopting QR code payments due to their convenience and low cost of implementation. This allows customers to make quick and easy payments using their smartphones.

Transaction Safety Tips

When using QR codes for digital payments, prioritizing transaction safety is crucial. Always verify the merchant’s identity and the payment amount before confirming any transaction.

Be wary of suspicious QR codes. Damaged, tampered with, or obscured codes could redirect your payment to fraudulent accounts. Avoid scanning QR codes received from unknown or untrusted sources, such as emails or text messages.

Protect your device. Ensure your smartphone or tablet has up-to-date security software and a strong passcode. Regularly check your bank statements for any unauthorized transactions. If you notice anything unusual, report it to your bank immediately.

Use reputable payment apps. Download and use payment apps from official app stores and research their security features. Understand the app’s policies regarding refunds and dispute resolution.

Tracking QR Payment History

Maintaining a clear record of your QR code payment transactions is crucial for budgeting and fraud prevention. Most digital payment platforms offer a built-in transaction history feature.

Typically, the transaction history will display key information such as:

- Date and time of the transaction

- Amount paid or received

- Merchant name or recipient

- Transaction ID or reference number

You can usually access your QR payment history through the app or website of your payment provider. Some platforms allow you to filter transactions by date range, merchant, or amount, facilitating easy reconciliation.

Regularly reviewing your QR payment history can help you identify any unauthorized transactions and take prompt action. It also provides valuable data for managing your finances effectively.