Managing your finances effectively starts with understanding your spending habits. One powerful tool at your disposal is your bank’s mobile app. Many banks now offer built-in features that allow you to set spending limits directly within the app. This allows for greater control over your budget and can help you avoid overspending. This article will guide you through the process of how to set spending limits in various bank apps, providing you with the knowledge to take control of your finances and achieve your financial goals. Learning how to set spending limits in your bank app can be a game-changer for your budget. Whether you’re looking to curb impulse purchases, stick to a stricter budget, or simply gain a better understanding of your spending patterns, using the spending limit features within your bank app can provide valuable support.

Setting spending limits within your bank app is often a simple and customizable process. Most bank apps allow you to set limits on various categories, such as dining, entertainment, or shopping. Some even allow for overall spending limits, giving you a holistic view of your financial outlays. This tutorial will cover the specific steps involved in setting spending limits in various popular bank apps. You’ll learn how to navigate the app interface, customize your limits, and set up notifications to alert you when you’re approaching your predefined thresholds. Utilizing these features can empower you to make informed financial decisions and achieve your budgeting objectives.

Understanding Spending Controls

Spending controls are tools provided by banks and financial institutions to help you manage and track your expenses. They empower you to set limits on your spending, providing a proactive approach to budgeting and financial health.

These controls typically function by categorizing transactions and allowing you to establish thresholds for each category. For example, you might set a limit on dining out, entertainment, or shopping. Once you approach or exceed your predefined limit, the app will typically notify you, allowing you to adjust your spending accordingly.

Understanding the various types of spending controls available is essential for effective budgeting. Some common types include:

- Transaction Limits: Restricting the amount spent per transaction.

- Category Limits: Limiting spending within specific categories like groceries or gas.

- Monthly/Weekly Limits: Setting an overall spending cap for a defined period.

By utilizing spending controls, you gain a clearer picture of your spending habits and enhance your ability to achieve your financial goals.

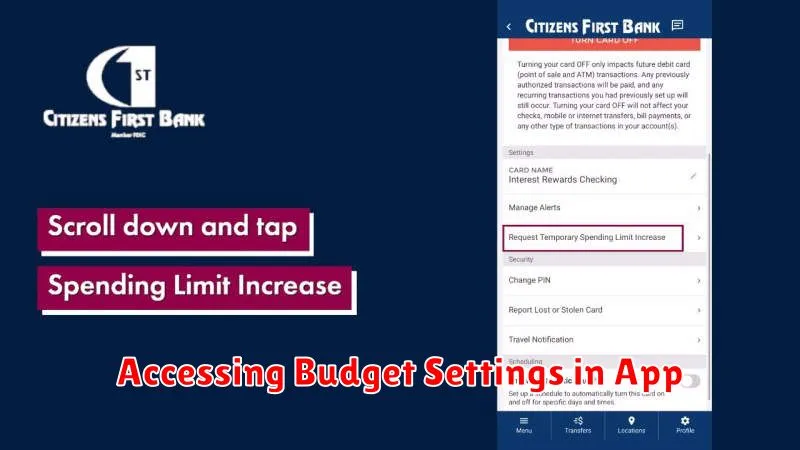

Accessing Budget Settings in App

Locating budget tools within your banking app is the first step toward effectively managing your finances. The specific location of these settings might vary slightly depending on your bank’s app interface. However, some common locations include a dedicated “Budget” or “Spending” tab within the main navigation menu.

Look for icons or labels such as a chart, graph, or a tag labeled “Budget,” “Spending,” or “Financial Tools.” In some apps, you may find these settings nested under a more general “Settings” or “Profile” section.

If you are having trouble locating the budget settings, utilize the app’s built-in search function. Searching for keywords like “budget,” “spending limit,” or “financial goals” can often lead you directly to the relevant section.

If you are still unable to find the budget settings, consult your bank’s app help resources or contact their customer support for assistance.

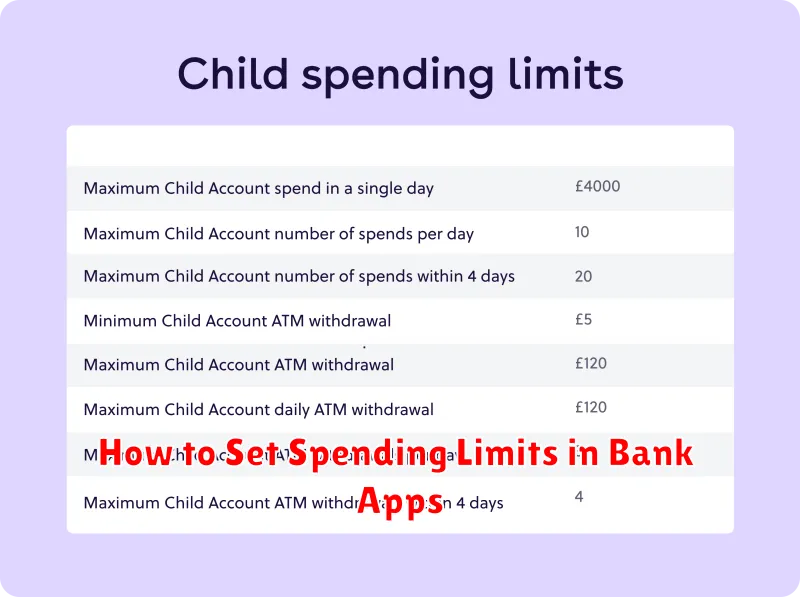

Setting Daily and Weekly Caps

Many banking apps offer the ability to set daily and weekly spending limits. This feature provides a proactive way to manage your finances and avoid overspending. By setting these caps, you essentially create a virtual “budget” that your transactions must adhere to.

Typically, you can find this feature within the app’s settings or budget management section. Look for options labeled “Spending Limits,” “Transaction Controls,” or similar terms. The process usually involves selecting the account you want to apply the limits to and specifying the monetary amount for each cap (daily and weekly).

Once activated, these limits prevent transactions that would exceed the set amount. You might receive a notification if a transaction is declined due to the limit. Some apps may offer the option to temporarily override the limit, but this should be done cautiously.

Linking to Budget Categories

Linking spending limits to budget categories is crucial for effective budget management within your banking app. This connection allows the app to automatically track your spending against predefined limits for specific categories like groceries, dining out, or entertainment.

Most banking apps offer a range of pre-set budget categories. You can typically customize these categories or create your own to align with your specific spending habits. For instance, you might create a category for “Home Improvement” or “Pet Expenses.”

Once categories are established, you can assign spending limits to each. This limit represents the maximum amount you intend to spend within that category during a given period, such as a month. When you make a purchase using your linked bank card or account, the app automatically categorizes the transaction and deducts the amount from your assigned limit.

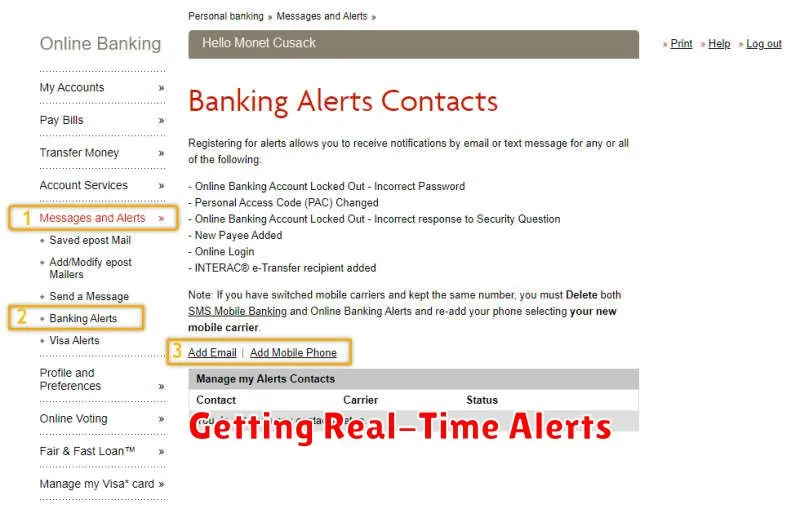

Getting Real-Time Alerts

Real-time alerts are crucial for managing your spending and staying within your budget. These alerts notify you immediately when specific transactions occur, giving you up-to-the-minute insight into your account activity. Most banking apps offer customizable alert options.

Common Alert Types:

- Low Balance Alerts: Receive a notification when your account balance falls below a specified threshold.

- Deposit Alerts: Get alerted when a deposit is made to your account.

- Large Purchase Alerts: Receive a notification when a transaction exceeds a set amount.

- Specific Merchant Alerts: Get notified when a purchase is made at a particular merchant.

By setting up real-time alerts, you can proactively monitor your spending and avoid overdraft fees or unnecessary expenses. You can quickly identify unauthorized transactions and take immediate action.

Adjusting Limits When Needed

Life changes, and so do your spending habits. It’s crucial to periodically review and adjust your spending limits within your banking app. This ensures you maintain control over your finances and avoid overspending.

Reasons for Adjustment: Several factors might necessitate adjustments, such as increased income, unexpected expenses, or changes in financial goals. Regularly assessing your budget and spending patterns will help you determine when adjustments are needed.

How to Adjust: Most banking apps offer a straightforward process for modifying spending limits. Typically, you’ll find this feature within the app’s settings or card management section. Look for options to edit or update your current limits. Carefully input your desired new limits, ensuring they align with your updated budget.