Managing subscription payments can be a hassle. Multiple platforms, varying billing cycles, and forgotten renewals can lead to unexpected charges and service interruptions. However, tracking these subscription payments has become significantly easier with the advent of digital banking apps. These apps provide a centralized platform to monitor and manage your finances, including your recurring subscription payments. This article will explore how digital banking apps empower you to effectively track, manage, and optimize your subscriptions, putting you back in control of your recurring expenses.

Gaining a comprehensive overview of your subscription payments is crucial for maintaining a healthy budget. Digital banking apps provide the tools necessary to achieve this clarity. From identifying recurring charges to setting up payment alerts and even canceling unwanted subscriptions directly through the app, these platforms offer a streamlined approach to subscription management. Learn how to leverage the power of digital banking apps to simplify your finances and take charge of your subscription payments.

Why Monitor Subscriptions?

Monitoring your subscriptions is crucial for maintaining control over your personal finances. Unnoticed recurring charges can accumulate quickly, impacting your budget and potentially leading to overdraft fees.

By actively tracking your subscriptions, you gain a clearer understanding of where your money is going. This awareness empowers you to make informed decisions about which services to continue and which ones to cancel, ultimately optimizing your spending.

Furthermore, monitoring subscriptions through digital banking apps helps detect potentially fraudulent activity. Unauthorized charges can be identified and addressed promptly, minimizing financial loss and protecting your personal information.

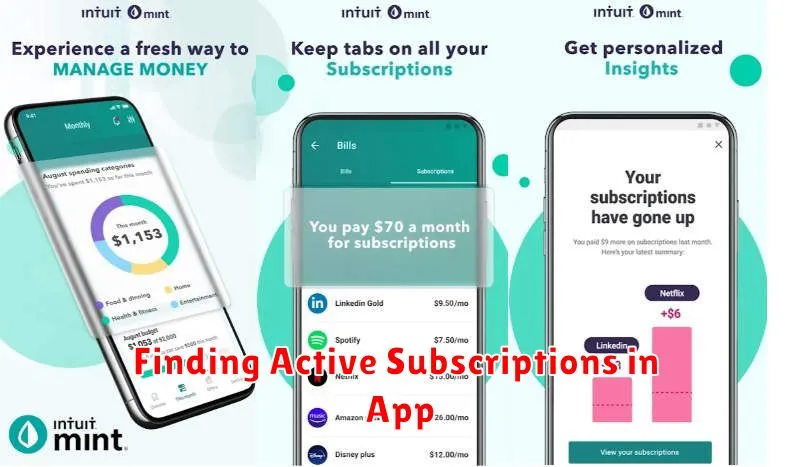

Finding Active Subscriptions in App

Locating your active subscriptions within a digital banking app can vary slightly depending on the specific app’s interface. However, most apps follow a similar pattern. Look for a section often labeled “Subscriptions,” “Recurring Payments,” or “Automatic Payments.” This may be located on the app’s main dashboard, under a “Payments” tab, or within account details.

Once you’ve found the appropriate section, you should see a list of your active subscriptions. This list will typically display the merchant’s name, the subscription amount, and the next payment date. Some apps may also offer additional details such as the subscription start date or a brief description of the service.

If you’re having trouble locating the subscription management area, consult the app’s help section or FAQ. You can also contact the bank’s customer support for assistance.

Identifying Unused Services

Digital banking apps provide a centralized platform to monitor subscription payments. This consolidated view allows for easier identification of unused or forgotten services.

Begin by carefully reviewing each recurring transaction listed in your app. Look for subscriptions you no longer use or need. Common culprits include streaming services, music subscriptions, or software licenses you may have signed up for and forgotten about.

Organizing your subscriptions within the app, if the functionality exists, can be beneficial. Categorizing by service type (entertainment, productivity, etc.) or cost can facilitate a more thorough review process.

Setting Alerts for Renewals

Timely renewal reminders are crucial for maintaining uninterrupted subscription services. Digital banking apps offer customizable alert features to help you stay on top of upcoming payments.

Most apps allow you to set alerts for specific amounts. This ensures you’re notified only when your subscription payment is processed, avoiding unnecessary notifications. You can also configure alerts for specific dates, aligning them with your subscription renewal date.

Some apps offer multiple alert methods. These can include push notifications directly to your device, SMS messages, or email alerts. Choose the method that best suits your communication preferences.

Customizing Alert Settings

The process for setting up renewal alerts varies slightly between apps. Typically, you’ll need to navigate to the alerts or notification section within your banking app. Look for options to create new alerts based on specific transaction amounts or dates.

Canceling with One Click

Digital banking apps are increasingly streamlining the subscription management process, offering a level of control previously unavailable. A key feature of this enhanced control is the ability to cancel subscriptions directly within the app.

One-click cancellation eliminates the need to navigate to individual vendor websites or contact customer support. This simplified process saves users time and effort, allowing them to quickly manage their recurring expenses.

Typically, users can locate their active subscriptions within a dedicated section of the banking app. From there, selecting a specific subscription reveals options for managing it, including the prominent “cancel” button. Confirmation prompts ensure users don’t accidentally cancel desired services.

Monthly Recap Reports

Digital banking applications often provide a valuable feature: monthly recap reports for subscription payments. These reports offer a consolidated view of all your recurring expenses, simplifying budget management and financial tracking.

Typically, these reports summarize crucial information, including:

- Subscription Name: Clearly identifies each individual subscription service.

- Payment Amount: Shows the amount charged for each subscription.

- Payment Date: Specifies the date each payment was processed.

- Total Monthly Spending: Provides a cumulative figure of all subscription payments made during the month.

Utilizing these reports allows for efficient expense monitoring. You can quickly identify trends in your spending, spot potential discrepancies, and make informed decisions about managing your subscriptions.