In today’s fast-paced world, more and more people are turning to digital banks as their primary financial institution. This shift towards online banking reflects a growing preference for convenience, accessibility, and innovative financial tools. But what is driving this trend? Why are so many ditching traditional brick-and-mortar banks in favor of digital banking solutions? This article explores the key reasons behind the increasing popularity of digital banks, highlighting their advantages and demonstrating why they are becoming the preferred choice for a growing segment of the population. From lower fees and higher interest rates to 24/7 account access and personalized financial management tools, digital banks offer a compelling alternative to traditional banking.

Traditional banking often involves physical branches, paper checks, and limited access to account information. Digital banks disrupt this model by offering online banking services accessible anytime, anywhere. This shift towards digital banking is powered by advancements in technology, changing consumer behaviors, and a desire for greater control over personal finances. By understanding the factors that contribute to this trend, we can gain insight into the future of banking and the significant role that digital banks will play in shaping the financial landscape. This article will delve into the specifics of why digital banks are gaining traction, providing concrete examples of how they are meeting the evolving needs of today’s consumers.

Convenience of 24/7 Access

Traditional banking often restricts access to services within branch operating hours. Digital banks transcend these limitations by offering 24/7 access to accounts and financial tools.

This constant availability allows customers to manage their finances whenever and wherever they need to. Whether it’s checking balances late at night, transferring funds on a weekend, or paying bills during a lunch break, digital banks provide the flexibility that modern life demands.

This anytime, anywhere access eliminates the need to physically visit a branch, saving customers valuable time and effort.

Lower Fees and Charges

A primary driver behind the rising popularity of digital banks is their significantly lower fee structure compared to traditional brick-and-mortar institutions. Digital banks often operate with lower overhead costs, enabling them to pass these savings on to customers.

This often translates to no monthly maintenance fees, free ATM withdrawals at a wider network of machines, and reduced or eliminated overdraft fees. Some digital banks also offer no foreign transaction fees, making them an attractive option for travelers.

| Fee Type | Traditional Bank | Digital Bank |

|---|---|---|

| Monthly Maintenance | Often $5-$15 | Typically $0 |

| Overdraft | Typically $35+ | Often $0 or reduced |

| ATM Withdrawal (Out-of-Network) | Typically $2-$5 | Often $0 at a larger network |

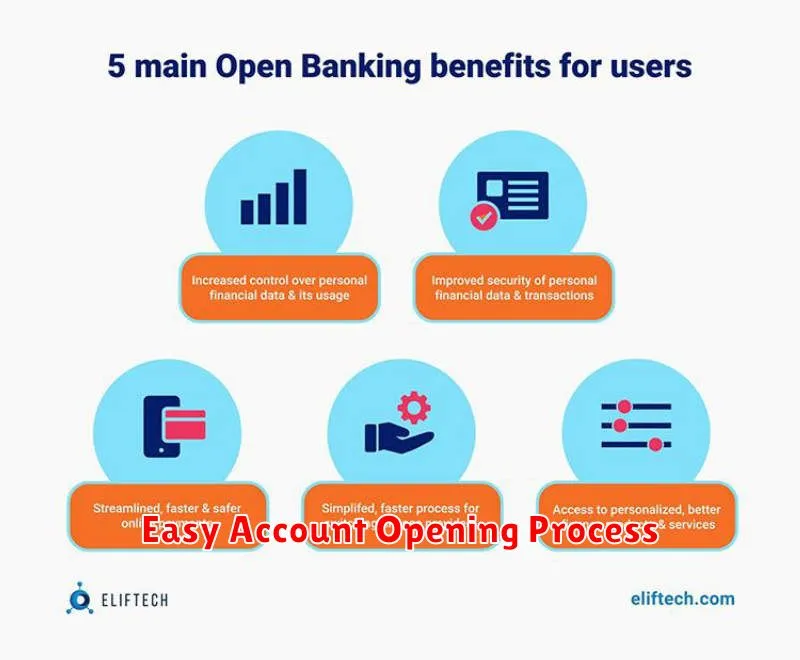

Easy Account Opening Process

One of the primary drivers behind the rise of digital banks is their streamlined account opening process. No longer do customers need to visit a physical branch and spend hours filling out paperwork. Instead, the entire process can often be completed online in a matter of minutes.

Typically, opening a digital bank account involves downloading the bank’s mobile application or visiting their website. Users are then guided through a simple registration process, often requiring basic information such as name, address, and identification verification. This ease of access removes significant barriers that traditionally discouraged individuals from opening and maintaining bank accounts.

Some digital banks employ advanced Know Your Customer (KYC) technology, allowing them to verify customer identities quickly and securely through digital means. This eliminates the need for physical documentation and further simplifies the account opening experience.

Faster Transactions and Transfers

Digital banks often offer significantly faster transaction processing compared to traditional institutions. This speed advantage stems from their streamlined, technology-driven infrastructure. They eliminate much of the manual processing and paperwork that can slow down transactions at brick-and-mortar banks.

Real-time transfers are a hallmark of digital banking. Customers can often send and receive money instantly, domestically and sometimes even internationally, without the delays typically associated with traditional banking systems.

This increased speed translates to greater convenience for users. Whether it’s paying bills, splitting costs with friends, or sending money to family, digital banking offers a more efficient and timely solution.

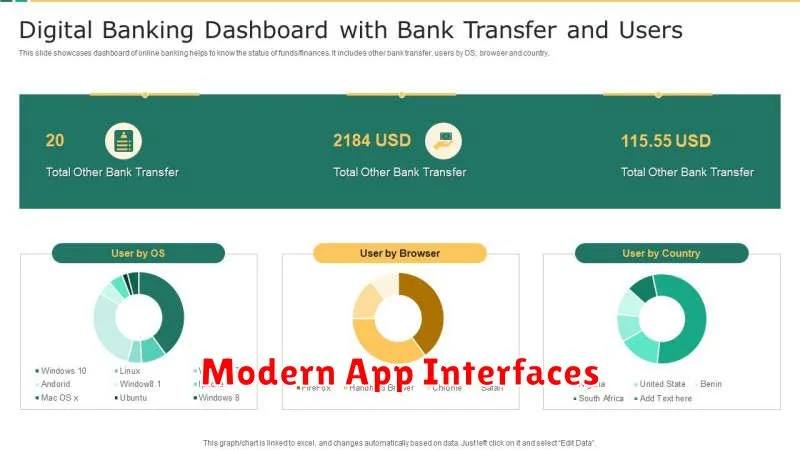

Modern App Interfaces

A key factor driving the shift towards digital banks is their emphasis on user experience, particularly through modern and intuitive app interfaces. Traditional banks often rely on outdated systems, resulting in clunky and complex online experiences. In contrast, digital banks prioritize sleek, user-friendly design.

These apps are often designed with mobile-first principles, recognizing that most users access their banking services primarily through their smartphones. This translates to interfaces optimized for smaller screens, with features like biometric login, real-time notifications, and easy-to-navigate menus.

This emphasis on simplicity and accessibility makes managing finances significantly easier and more convenient for users, contributing to the increasing popularity of digital banking.

Customer-Centric Services

A key differentiator for digital banks is their intense focus on the customer experience. Unlike traditional banks, digital banks are built from the ground up with a customer-centric approach. This translates to several key advantages.

24/7 Availability: Customers can access their accounts and conduct transactions anytime, anywhere, through user-friendly mobile apps and online platforms. This eliminates the constraints of traditional banking hours and physical branch locations.

Personalized Services: Digital banks leverage data and technology to offer personalized financial management tools, customized advice, and targeted product offerings. This allows for a more tailored and relevant banking experience.

Streamlined Processes: Account opening, loan applications, and other banking processes are often fully digitized and simplified, reducing paperwork and wait times significantly.

Enhanced Communication: Digital banks often offer multiple communication channels, including in-app chat, email, and social media, allowing for quick and easy access to customer support.